Types of Mutual Funds that give you High Return

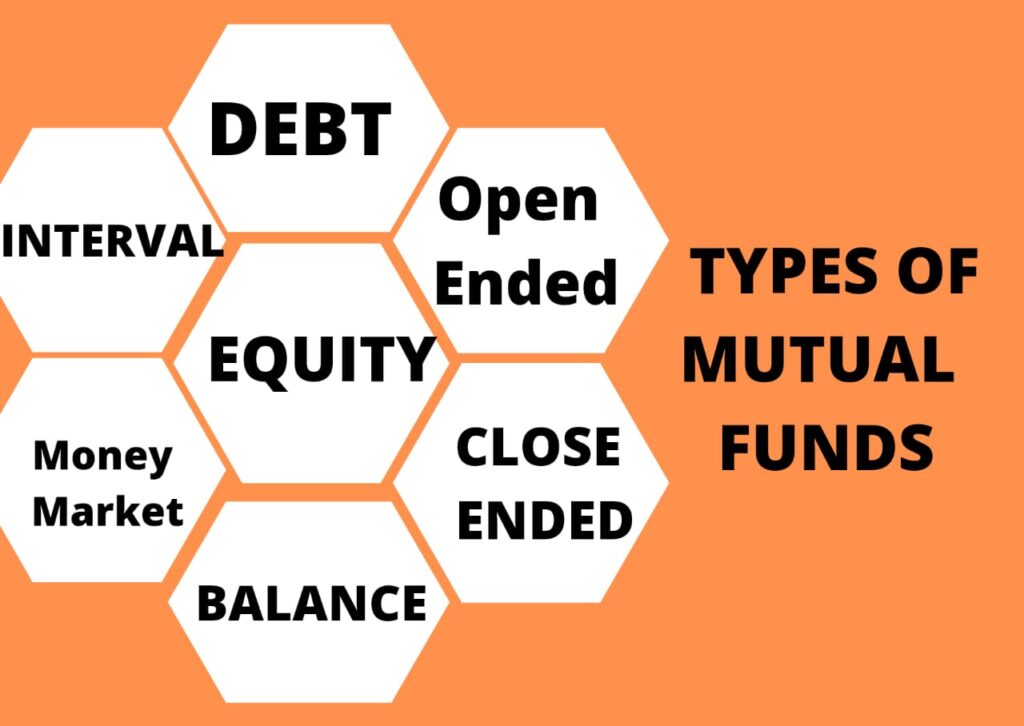

Are you considering investing in mutual funds? Then you must understand the various mutual fund types and the advantages they provide. Different characteristics can be used to classify mutual funds. Let’s Learn more about the different kinds of mutual funds below:

Based on Structure

The structural classification – open-ended funds, close-ended funds, and interval funds – is relatively broad, and the main distinction is the ability to buy and sell individual mutual fund units.

Open-Ended Funds

Units in these funds are available for purchase or redemption throughout the year. These fund units are purchased and redeemed at the current NAV. In essence, these funds will allow investors to invest for as long as they desire. There are no restrictions on how much money can be put into the fund. They’re also more likely to be actively managed, which means a fund manager selects where your money will be invested. Because of the active management, these funds may charge a greater fee than passively managed funds. Because they are not tied to any certain maturity periods, they are an excellent investment for people looking for both investment and liquidity.

Close-Ended Funds

Closed-ended funds have pre-determined unit capital. This means that the fund company can only sell a certain amount of units. Some funds have a New Fund Offer (NFO) period during which you can buy units. NFOs have a pre-determined maturity period, with fund managers accepting any fund size. As a result, SEBI has recommended that investors be given the option of repurchasing the funds or listing them on stock exchanges in order to exit the schemes.

Interval Funds

Interval funds have both open-ended and closed-ended characteristics. These funds are only available for buy or redemption at particular intervals (determined by the fund house) and are otherwise closed. There will also be no transactions for at least two years. These funds are best for investors who want to put aside a large sum of money for a short-term ( 3 – 12 months) financial goal.

Based on Asset Class

Equity Funds

These are funds that invest in company equity stocks/shares. These funds are considered high-risk, yet they also offer high returns. Infrastructure, rapid-moving consumer products, and banking, to mention a few, are examples of specialized funds. They are market-linked and have a tendency to fluctuate.

Debt Funds

Debt funds invest in debt securities such as corporate debentures, government bonds, and other fixed-income assets. They are regarded as secure investments with predictable returns. These funds do not deduct tax at source, thus if the investment earns more than Rs. 10,000, the investor is responsible for paying the tax.

Money Market Funds

These are funds that invest in liquid assets such as T-Bills, CPs, and other similar securities. They are considered safe investments for those seeking immediate but limited returns on extra finances. Money markets, often known as cash markets, involve risks such as interest risk, reinvestment risk, and credit risk.

Balanced and Hybrid Funds

These are mutual funds that invest in a variety of assets. In some scenarios, the proportion of equity exceeds that of debt, while in others, the opposite occurs. This method balances risk and reward. Franklin India Balanced Fund-DP (G) is an example of a hybrid fund because it invests 65 percent to 80 percent of its assets in equities and the balance 20 percent to 35 percent in debt. This is due to the fact that the debt markets are less risky than the stock markets.

Disclaimer– This Website and related pages are only for information, educational & learning assistance. Please consult your financial advisor for assistance before investing. Personal opinion only for reviews, feedback, and educational purpose. We are not SEBI registered.

3 thoughts on “Types of Mutual Funds that give you High Return”